Top Guidelines Of Mortgage Broker Assistant

Wiki Article

What Does Mortgage Broker Vs Loan Officer Do?

Table of ContentsWhat Does Mortgage Broker Meaning Mean?Not known Facts About Mortgage Broker Assistant Job DescriptionNot known Details About Mortgage Broker Average Salary The Only Guide to Broker Mortgage MeaningThe Mortgage Broker Salary IdeasThe 20-Second Trick For Mortgage Broker Job DescriptionThe Only Guide to Broker Mortgage CalculatorRumored Buzz on Mortgage Broker Vs Loan Officer

What Is a Mortgage Broker? A home mortgage broker is an intermediary in between an economic establishment that uses car loans that are secured with realty and also individuals interested in buying property who need to obtain cash in the type of a lending to do so. The home mortgage broker will collaborate with both parties to obtain the private approved for the loan.A home mortgage broker typically works with various lending institutions and also can provide a selection of finance alternatives to the borrower they deal with. What Does a Home loan Broker Do? A home mortgage broker aims to complete realty deals as a third-party intermediary between a customer and a lender. The broker will certainly collect details from the individual as well as go to multiple lenders in order to discover the very best prospective car loan for their client.

The Best Strategy To Use For Broker Mortgage Meaning

All-time Low Line: Do I Need A Home Mortgage Broker? Working with a mortgage broker can conserve the borrower effort and time during the application process, and also potentially a lot of money over the life of the financing. On top of that, some lending institutions work exclusively with mortgage brokers, suggesting that debtors would certainly have access to financings that would certainly otherwise not be offered to them.It's vital to examine all the costs, both those you might need to pay the broker, along with any kind of fees the broker can aid you avoid, when weighing the choice to deal with a home loan broker.

All about Broker Mortgage Rates

You've most likely heard the term "mortgage broker" from your realty representative or close friends that have actually bought a residence. What precisely is a home loan broker and also what does one do that's different from, claim, a financing policeman at a financial institution? Geek, Pocketbook Guide to COVID-19Get response to questions regarding your mortgage, travel, funds and maintaining your comfort.1. What is a mortgage broker? A mortgage broker serves as a middleman between you and also prospective lending institutions. The broker's work is to contrast home mortgage lending institutions in your place and also locate rate of interest that fit your needs - mortgage broker assistant. Home mortgage brokers have stables of lending institutions they function with, which can make your life less complicated.

10 Easy Facts About Mortgage Broker Association Shown

Exactly how does a home loan broker obtain paid? Home loan brokers are most frequently paid by lending institutions, occasionally by borrowers, however, by regulation, never both.What makes home mortgage brokers different from funding policemans? Financing police officers are workers of one lending institution that are paid established wages (plus bonuses). Financing policemans can write only content the types of loans their company picks to provide.

Top Guidelines Of Mortgage Broker Meaning

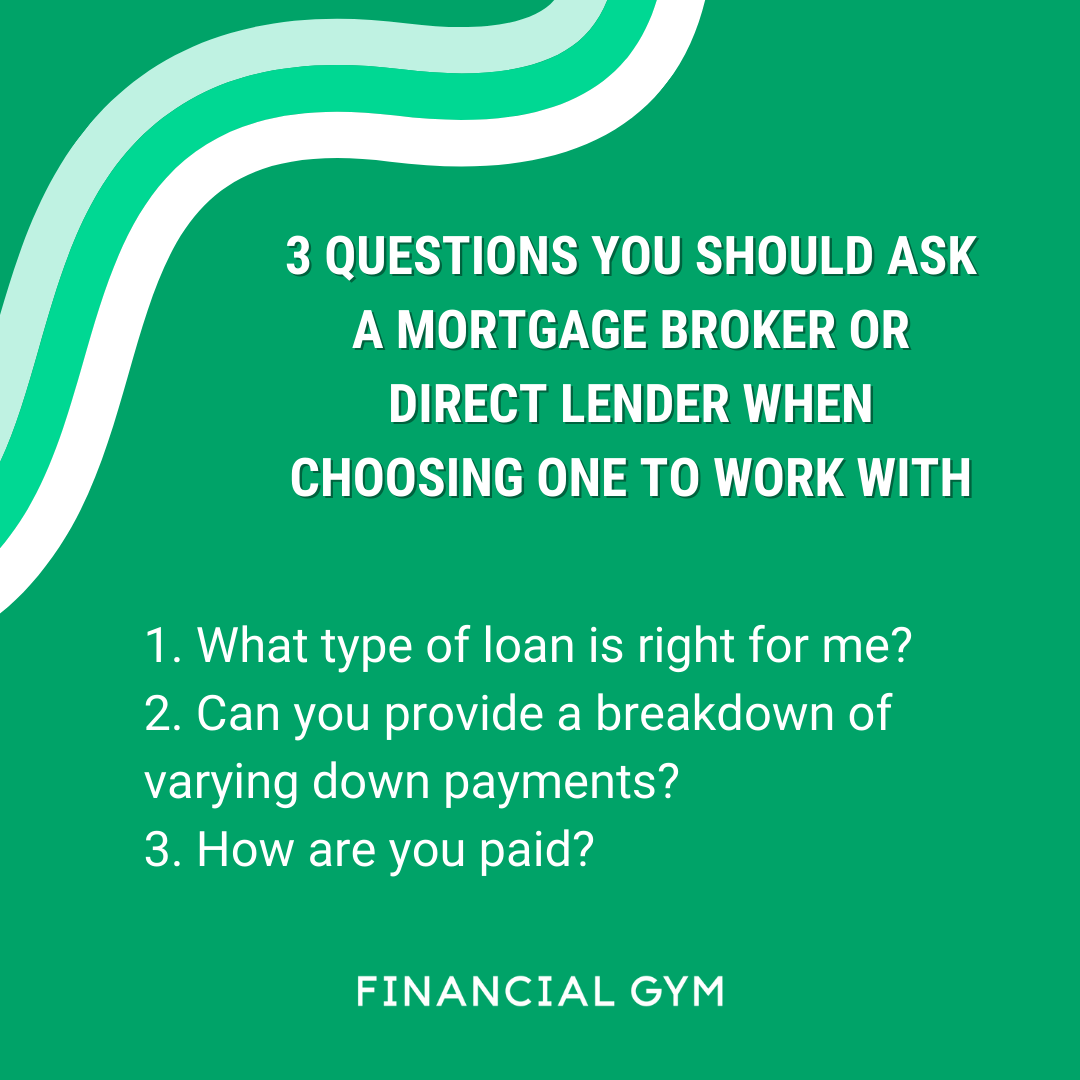

Home loan brokers might have the ability to offer customers accessibility to a wide option of car loan types. 4. Is a mortgage broker right for me? You can save time by utilizing a mortgage broker; it can take hrs to get preapproval with various lenders, then there's the back-and-forth communication involved in underwriting the car loan and also guaranteeing the this post purchase remains on track.When choosing any kind of lending institution whether via a broker or directly you'll want to pay interest to loan provider charges." Then, take the Lending Estimate you receive from each lending institution, place them side by side as well as compare your interest price and all of the charges as well as closing costs.

Little Known Facts About Broker Mortgage Calculator.

5. Exactly how do I select a home mortgage broker? The very best means is to ask buddies and also relatives for references, but make certain they have in fact used the broker and also aren't just going down the name of a former university flatmate or a remote associate. Find out all you can regarding the broker's solutions, communication style, degree of expertise and also approach to customers.

Fascination About Mortgage Broker Association

Competitors and also house prices will influence how much mortgage brokers obtain paid. What's the distinction in between a home mortgage broker and also a financing police officer? Loan police officers work for one lending institution.

3 Simple Techniques For Mortgage Broker Vs Loan Officer

Buying a new residence is just one of one of the most complex occasions in a person's life. Characteristic vary considerably in terms of style, services, school district as well as, naturally, the constantly essential "area, place, area." The home loan application procedure is a difficult element of the homebuying process, especially for those without past experience.

Can identify which concerns could develop problems with one lender versus an additional. Why some customers prevent mortgage brokers Sometimes property buyers really feel much more comfortable going directly to a huge bank to secure their loan. In that situation, customers should at least consult with a broker in order to recognize all of their choices relating to the kind of funding and also the available price.

Report this wiki page